Your Access to the Exclusive

World of Blue-Chip Art Investing

Partasio is your opportunity to diversify your financial portfolio

Invest in blue-chip art and benefit from its strong historical financial returns

Partasio is your opportunity to diversify your financial portfolio

Invest in blue-chip art and benefit from its strong historical financial returns

Throughout history, people and cultures have produced art as an expression and a record of their customs, living conditions and important historic events.

The combination of art as a financial asset and cultural good makes it appealing throughout the world.

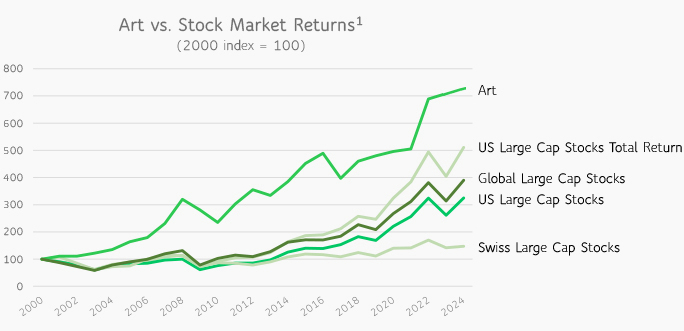

Investing in blue-chip art has yielded annual returns of 8.9% since 2000, beating the performance of most stock markets during that time period.

Art provides great financial portfolio diversification given its low correlation with other asset classes.

Art

0.12

0.25

0.04

-0.18

0.09

0.09

Art

0.12

0.25

0.04

-0.18

0.09

0.09

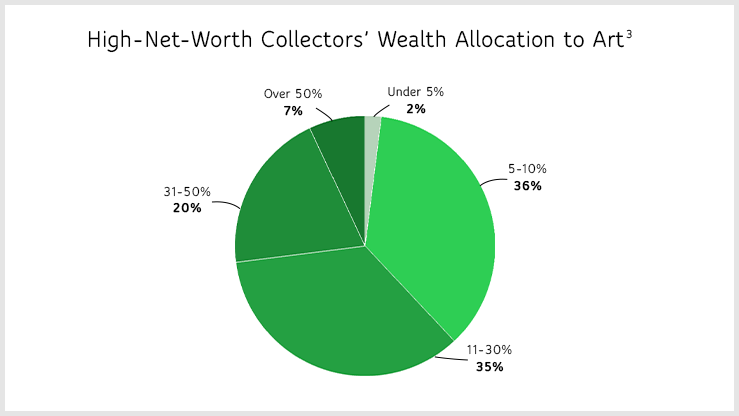

Individuals who not only possess financial resources but also art market access allocate a large proportion of their wealth to art.

62% of high-net-worth collectors allocate more than 10% of their wealth to art.

Blue-chip art is made by artists who demonstrate the highest degree of continued art market relevance from a cultural, historical and financial perspective. Therefore, blue-chip art generates the highest risk-adjusted, long-term financial returns.

To become blue-chip, artists undergo key events in their careers such as major gallery representation, museum solo shows and auction records.

Blue-chip art is very expensive. Prices usually start at around USD 1 million per artwork.

The art market is opaque and information about prices is asymmetrical.

Blue-chip artworks are hard to find. To access this exclusive market you need a trustworthy partner.

Simply put, Partasio is an investment firm in art. We allow investors to invest into portfolios of blue-chip paintings. Our portfolios contain 4-6 carefully selected paintings, which we believe will appreciate in value. We buy the paintings off-market through our extensive network rather than through public auctions. The portfolio is held by a single purpose vehicle. Investors can buy notes issued by the single purpose vehicle that entitle them to their pro rata share of the cash flow (both ongoing and at disposal) generated by the portfolio. The intended holding period of a painting is around 5 years; during this time, Partasio actively manages the paintings and is responsible for maintenance such as insurance, logistics and storage. Partasio is also responsible for finding the most opportune timing and channel to sell paintings, again by leveraging our extensive network.

Crucially, Partasio interests are 100% aligned with our investors’. Partasio charges a performance fee when the painting is sold, the amount of which is based on the profit at the time of sale. Further, any maintenance fees incurred after a 5-year holding period are borne solely by Partasio, further incentivizing us to find a buyer within the estimated holding period.

The structure is bankable and done via an actively managed certificate. Investors purchase notes issued by a single purpose vehicle in the shape of a Guernsey protected cell company (the “PCC”). Each PCC has its own Swiss ISIN. The PCC is the legal owner of the paintings underlying a given portfolio. The PCC has no indebtedness, no other assets and does not conduct any operations other than relating to the ownership, maintenance and eventual sale of the paintings. Noteholders are entitled to pro rata cash flows (after costs and fees) generated by the underlying paintings. As paintings do not generate cash flow noteholders are entitled to pro rata net disposal proceeds (after costs and fees) when paintings are sold. Commercially this means that if you own 1% of the notes issued by a PCC for instance, you own a 1% share of the paintings owned by the PCC and therefore are eligible to 1% of the cash flow (after costs and fees) generated by the sale of such paintings.

The art world is vast – however, we focus exclusively on blue-chip contemporary paintings.

We have a set of stringent internal parameters, both quantitative and qualitative, that we use to define blue-chip art. There are around 40 artists who meet these criteria. These artists demonstrate long-term and global relevance both from a financial and art historical perspective. They generate significantly higher historical financial returns, lower volatility and a lower loss rate than the overall art market.

In order to source artworks from these high-profile artists, we rely on the extensive network of our senior art experts. With over 20 years of international art market experience each, they have curated the relationships and expertise to access paintings via private, off-market channels. When sourcing paintings, we consider both the purchase price compared to estimated market value and the future upside potential. Our objective is to maximize risk-adjusted financial returns while minimizing the downside risk as much as possible.

You do not need to be an art market expert to invest. Partasio’s expertise is to source, manage and eventually sell the paintings for a profit. As an investor, you only need to select the portfolio you want to invest in and you will receive regular updates throughout the holding period.

Our team consists of accomplished art market experts who have significant knowledge of, and experience in, the blue-chip art market. Our experts’ network and access are global and focused on sourcing the best blue-chip artworks for a given portfolio. Our network enables us to focus exclusively on private, off-market transactions at purchase, and to find the most opportune timing and channel when we decide to sell a painting.

During the holding period, Partasio works with the most experienced handlers, shippers, framers and insurance experts to minimize any risk of a loss in value. We also actively manage the portfolios giving the paintings exposure, elevating both their exhibition and publication history. Throughout our work, we help you stay on top of the market, providing continuous learning opportunities around the artists in your portfolio and the market in general.

Last but not least, the investment is structured so that the Partasio’s interests are 100% aligned with those of our investors. Partasio makes money by charging a performance fee when a painting is sold. Performance fee is only due if a painting is sold for a profit. Therefore, Partasio is highly incentivized to maximize profits for investors. For a detailed breakdown of all fees, please refer to the Termsheet.

We believe that diversification within the art market is absolutely essential to minimize risk. For that reason, we give you the opportunity to invest into small portfolios containing 4 to 6 paintings each rather than into individual paintings.

The estimated average holding period per painting is around 3 to 7 years. In order to mitigate the investor’s risk of a long holding period for a specific painting, Partasio only collects ongoing painting maintenance costs for insurance, storage, transportation, etc. for 5 years. If the holding period exceeds 5 years, the future maintenance costs will be borne solely by Partasio. This further aligns the interests of Partasio and investors to provide maximum profit within a reasonable holding period.

The PCC delegates all painting maintenance such as insurance, storage, transportation, etc. to Partasio for the duration of the holding period.

Absolutely, yes. Transparency is a core part of our business. As an investor, we keep you updated as soon as a painting is purchased (including investment rationale). We also inform you when a painting is sold of course.

One of the beauties of investing in art is that the underlying product is a real asset. Of course, we want to give you the opportunity to view the paintings that are part of your investment. For that reason, we organize events and exhibitions where we display the paintings.

If the net sales price of a painting is higher than the sum of its purchase price and ongoing costs, you make a profit. Upon the sale of each painting in a portfolio, net sales proceeds after fees are distributed to investors.

You must meet the professional investor requirements pursuant to the Swiss Financial Services Act to be eligible to invest. This generally requires (1) proven financial experience and at least CHF 500,000 of financial assets or (2) at least CHF 2 million of financial assets. Feel free to contact us on support@partasio.com if you have any questions about these requirements.

If you meet these criteria, please sign up to free membership on our website. Visit the Opportunities section of the website to explore current investment opportunities. Once you select the opportunity you are interested in, carefully read through the relevant Termsheet shown as part of that opportunity. To invest, follow the purchase instructions that are shown as part of that opportunity. This usually consists of sending the Termsheet which includes the ISIN and the desired investment amount to your bank so they can execute the trade on your behalf.

The minimum investment is CHF 30,000.

Absolutely not! The money you invest is going directly to the paying agent, a bank that holds the money in the name of the PCC. The money will only be used to purchase paintings and to pay ongoing costs such as management and administrative fees as outlined in the Termsheet. Partasio never has access to the money.

Partasio does not provide tax advice. We recommend that investors refer to the Termsheet regarding tax treatment and obtain their own tax advice as every person has specific tax circumstances. Generally, for individuals with tax domicile in Switzerland, gains and losses realized from the sale of the underlying paintings should be considered as private capital gains and non-tax-deductible private capital losses, respectively.

Please reach out to us on support@partasio.com if you decide to sell your notes prior to all paintings in a portfolio having been sold. We will do our best to match you with an interested buyer from our broad investor base.

The sum of the value of the underlying paintings and cash held by the paying agent in the name of the PCC minus accrued costs and fees, divided by the number of notes outstanding equals NAV. Please refer to the Termsheet for detailed calculations.

The paintings are valued at least once per year by an independent, third-party art valuation company using market standard valuation practices.

We continuously provide updates about the latest developments in the international art market. If you are an investor, we provide you with a specific update about the paintings included in your portfolio at least twice a year. This report includes the latest NAV figure as well as any trends and developments that could have an impact on the value of the paintings in the portfolio.

If there are any questions or problems during the investment process, please contact us on investments@partasio.com. A member of our team will get back to you without delay to resolve any issues that may arise.

If you have any questions, email us at support@partasio.com. A member of our team will get back to you to answer any questions you may have.

© Copyrights 2022-2024. All Rights Reserved. Partasio AG